Rule 409: Offers to Pay Medical and Similar Expenses

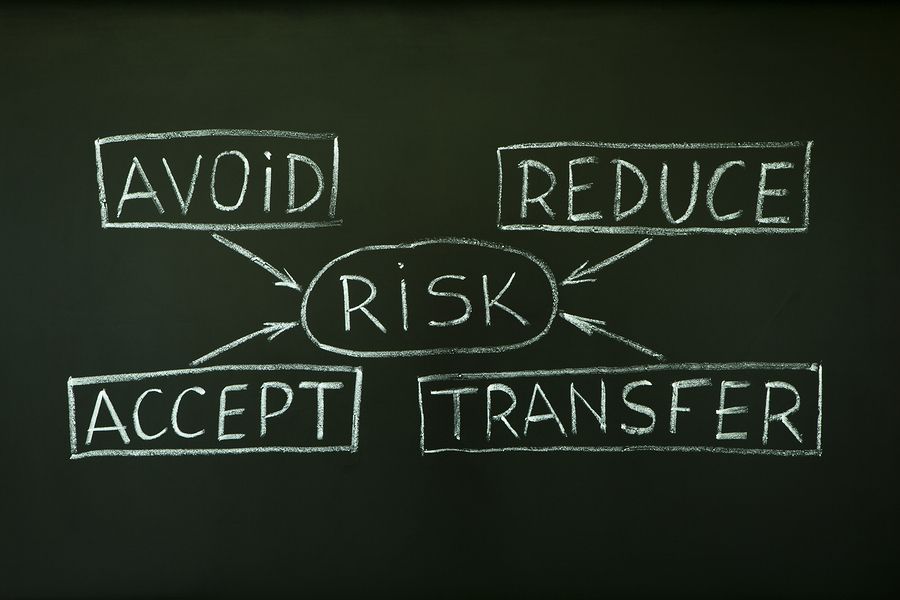

Risk cannot be fully eliminated. Part of being a business leader is accepting and mitigating risk. Accidents are a side effect of doing business.

From primary costs to societal costs, accidents are costly. When one occurs, businesses need to respond by assisting the injured. Prompt medical attention reduces the likelihood of serious injury. Indeed, minor untreated injuries can become serious. Whether you are liable or not, offering to pay for the associated medical expenses upfront can greatly decrease your overall risk. Unless, the probative value is substantially outweighed, the evidence of offering to pay or paying cannot be used against you to prove liability.

Rule 409 (The Federal Rules of Evidence) states, “Evidence of furnishing, promising to pay, or offering to pay medical, hospital, or similar expenses resulting from an injury is not admissible to prove liability for the injury.” Indeed, Rule 409 is policy driven to encourage companies to pay for the medical expenses of those injured on their premises. Nonetheless, Rule 409 does not preclude the admission of accompanying statements or the admission to prove a different fact at issue that is not liability. To develop an accident protocol to help mitigate risk, contact us.

Posted by Sarah Crabtree Perez and Chad Trownson